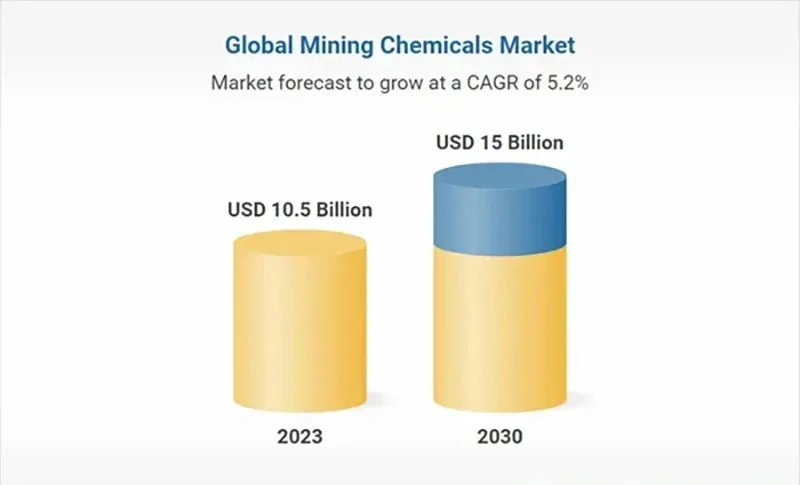

The mining and metals industry is an important pillar of global infrastructure, manufacturing, and technological advancement. The global mining and metals market reached $1.5 trillion in 2023 and is expected to reach $1.57 trillion in 2024. The mining and metals market is expected to grow to $2.36 trillion by 2031, at a compound annual growth rate (CAGR) of 5.20%. This growth is mainly driven by increasing urbanization, industrialization in emerging markets, and advancements in sustainable mining practices. In 2023, the precious metals market, including gold and silver, reached $350 billion, showing strong demand from investors and industrial applications. In addition, the global industrial metals market, such as copper, aluminum, and zinc, is expected to exceed $800 billion by 2026, driven by infrastructure construction, automotive manufacturing, and renewable energy projects. The transition to electric vehicles and renewable energy is driving demand for key metals used in batteries and solar panels, thereby reshaping market dynamics.

Emerging markets, such as China, India, and Brazil, play a key role in shaping the future of the mining and metals industry. Rapid urbanization and infrastructure investment are driving significant demand for construction materials and industrial metals. For example, China’s steel production, a key indicator of global metal demand, will grow steadily on the back of government stimulus and urban development plans. In addition to market expansion, the industry is also undergoing a paradigm shift toward sustainable mining practices and environmental management.

The application of technologies such as autonomous vehicles, remote sensing, and artificial intelligence analytics are improving operational efficiency and minimizing environmental impact. The global market for sustainable mining solutions, including water management systems and renewable energy integration, will grow at a CAGR of 7.9% to reach $12.4 billion by 2026. Regulatory frameworks that promote responsible mining practices and community engagement are also shaping industry trends. Stakeholders are increasingly placing emphasis on transparency, ethical sourcing, and social responsibility in mining operations. As the mining and metals markets continue to evolve, investments in technological innovation, resource efficiency, and ESG (environmental, social, and governance) initiatives are critical to driving sustainable growth and resilience in global supply chains.

Global Mining Landscape: Key Regions and Trends

China (market size: US$299 billion)

As of 2023, China dominates the global mining and metals market, with a market share of 27.3% and a market size of US$299 billion. The country’s strong industrial infrastructure and extensive mining operations contribute significantly to its market size. China’s focus on infrastructure development, including roads, railways and urbanization projects, is driving demand for metals such as steel and aluminum. Additionally, China’s strategic investments in renewable energy and electric vehicles have strengthened markets for metals needed for battery manufacturing and renewable energy infrastructure. China’s leading position in the global mining and metals market is further supported by government policies to promote mining activities and advancements in mining technology.

Australia (Market Size: $234 billion)

According to market research, Australia holds a significant position in the global mining and metals market, accounting for 13.2% of the market share and a market size of $234 billion. The country’s rich mineral resources, including iron ore, coal, gold, and copper, contribute significantly to its market position. Australia’s mining market benefits from advanced mining technology and infrastructure, ensuring efficient extraction and export capabilities. The mining industry plays a key role in Australia’s economy, with mining exports being a major source of revenue. In addition, Australia’s strict environmental regulations and focus on sustainable mining practices enhance its appeal as a reliable source of high-quality metals and minerals worldwide.

United States (Market Size: $156 billion)

The United States holds a significant position in the global mining and metals market with a market share of 12% and a market size of $156 billion in 2023. The mining market in the United States is diverse and includes metals such as copper, gold, silver, and rare earth elements. The country’s mining industry benefits from advanced technology and infrastructure, ensuring efficient extraction and processing operations. Key drivers of growth include demand from the construction, automotive, and aerospace markets, which are heavily dependent on metals such as steel, aluminum, and titanium. In addition, the U.S. market is influenced by its emphasis on technological innovation and sustainable mining practices, which are supported by a regulatory framework that promotes environmental management and resource efficiency.

Russia (Market size: $130 billion)

Russia plays a major role in the global mining and metals market, with a market share of 10% and a market size of $130 billion. The country’s rich mineral resources, including iron ore, nickel, aluminum, and palladium, support its strong market position. Russia’s mining industry benefits from extensive resources and efficient mining capabilities, supported by a strong infrastructure network. Key markets driving demand include metallurgy, construction, and machine building, which are heavily dependent on Russian metals. In addition, Russia’s geopolitical position as a major metal supplier to the global market enhances its strategic importance in the mining and metals market. Government initiatives aimed at modernizing mining operations and promoting technological innovation further enhance Russia’s competitive advantage in the global mining market.

Canada (Market Size: $117 billion)

Canada holds a significant position in the global mining and metals market with a market share of 9% and a market size of $117 billion. The country’s mining market is characterized by abundant natural resources, including significant gold, copper, nickel, and uranium deposits. Canada’s mining industry benefits from advanced technologies and environmentally responsible practices that ensure sustainable resource extraction and processing. Key drivers of growth include strong demand from the energy, infrastructure, and manufacturing markets, which are heavily dependent on Canadian metals. In addition, Canada’s stable political environment and supportive regulatory framework have boosted investor confidence in the mining market. Strategic investments in infrastructure and innovation have further enhanced Canada’s competitiveness in the global mining market.

Brazil (market size: US$91 billion)

According to market research, Brazil plays a key role in the global mining and metals market with a market share of 7% and a market size of US$91 billion. The country has extensive mineral resources, including iron ore, bauxite and manganese, driving its prominence in the global market. Brazil’s mining industry benefits from modern mining technology and infrastructure, promoting efficient production and export capabilities. Key sectors driving demand include steel production, car manufacturing and infrastructure construction, which rely heavily on Brazilian metals. Additionally, Brazil’s geography and economic size make it a major supplier to global markets, especially in South America. Government initiatives to promote sustainable mining practices and attract foreign investment further support Brazil’s role as a key player in the global mining and metals market.

Mexico (market size: $26 billion)

Mexico occupies a prominent position in the global mining and metals market, with a market share of 2% and a market size of US$26 billion. The country’s mining market is diverse and includes precious metals such as silver, gold, and copper, as well as industrial minerals such as zinc and lead. Mexico benefits from its rich geological endowments and favorable mining policies that encourage investment and development. Key drivers of growth include strong demand from domestic sectors such as construction, automotive and electronics, which rely on Mexican metals. Additionally, Mexico’s strategic location and trade agreements facilitate exports to key markets such as the United States and Canada. The Mexican government’s efforts to modernize infrastructure and promote sustainable mining practices have further strengthened the competitiveness of its mining industry on the global stage.

South Africa (market size: US$71.5 billion)

South Africa maintains a significant presence in the global mining and metals market, with a market share of 5.5% and a market size of US$71.5 billion. The country is known for its rich mineral resources, including platinum, gold, manganese and coal, underpinning its strong market position. South Africa’s mining industry benefits from advanced mining technology and infrastructure, ensuring efficient production and export capabilities. Key sectors driving demand include mining equipment manufacturing, automotive catalytic converters and jewelry manufacturing, all of which rely heavily on South African metals. Furthermore, South Africa’s mining market plays a key role in the country’s economy, providing employment and generating important export earnings. Government initiatives to promote sustainable mining practices and address socio-economic challenges have further enhanced South Africa’s competitiveness in the global mining and metals market.

Chile (market size: US$52 billion)

According to market research, Chile occupies a significant position in the global mining and metals market, with a market share of 4.0% and a market size of US$52 billion. The country is known for its vast copper reserves, making it the world’s leading producer of this important metal. Chile’s mining market also includes significant lithium, gold and silver deposits, contributing to its diverse mineral resources. The industry benefits from advanced mining technology and infrastructure, ensuring efficient mining and processing operations. Key drivers of growth include global demand for copper, driven by developments in industries such as electronics, construction and renewable energy. Additionally, Chile’s stable political environment and supportive regulatory framework have enhanced investor confidence in the mining market. Strategic investments in sustainability and innovation further strengthen Chile’s competitive advantage in the global mining market.

India (market size: US$45.5 billion)

India plays a growing role in the global mining and metals market with a market share of 3.5% and a market size of US$45.5 billion. The country’s mining market is diverse and includes metals such as iron ore, coal, aluminum and zinc. India’s mining industry benefits from extensive mineral resources and growing domestic demand driven by the infrastructure, manufacturing and automotive sectors. The market is supported by developments in mining technology and infrastructure, ensuring efficient mining and processing capabilities. Key growth drivers include government initiatives to boost domestic production, attract foreign investment and promote sustainable mining practices. India’s strategic geographical location and strong industrial base further contribute to its prominence in the global mining and metals market.